A Criminal Mind

Donald Trump's Pattern of Legal Evasion and Exploitation: A Case Study in Operating Like a Criminal

Donald Trump, the real estate mogul turned politician, has built a career marked by repeated instances of bending, breaking, or ignoring laws to enrich himself and evade accountability. While not all actions detailed here resulted in criminal convictions, they collectively paint a picture of a figure who treats legal boundaries as negotiable obstacles. From his early business dealings to his time in the White House and beyond, Trump's history is rife with examples of fraud, discrimination, non-payment of debts, and abuses of power. This article draws on public records, court cases, and investigative reports to substantiate these claims, highlighting both high-profile scandals and lesser-known controversies.

Early Business Practices: Discrimination and Mob Ties

Trump's entry into the real estate world in the 1970s was marred by allegations of racial discrimination, setting a tone of exploiting legal loopholes for profit. In 1973, the U.S. Department of Justice sued Trump and his father, Fred Trump, for violating the Fair Housing Act by systematically discriminating against Black applicants in their apartment buildings. (congress.gov) Evidence included doormen marking applications from minorities with codes like "C" for "colored," and Trump properties rejecting Black tenants while approving white ones with similar qualifications. (politico.com) The Trumps settled the case in 1975 without admitting guilt, but the suit required them to implement fair housing practices, which critics argue were minimally enforced. (clearinghouse.net) This early controversy allowed Trump to maintain profitable operations in a segregated market, enriching his family empire at the expense of equal access.

Compounding this, Trump's business ventures often intersected with organized crime figures, enabling him to secure deals and labor in New York's cutthroat construction scene. During the 1980s, Trump Tower's construction involved concrete from companies controlled by mob bosses like Anthony "Fat Tony" Salerno of the Genovese crime family. (politico.com) Trump also associated with Roy Cohn, a lawyer with deep mafia ties, who helped him navigate legal hurdles. (esquire.com) In Atlantic City, Trump partnered with individuals linked to Philadelphia mobster Nicky Scarfo for casino developments. (legalnews.com) These connections provided cheap labor and materials but skirted ethical and legal norms, allowing Trump to profit from ventures that might otherwise have stalled. (motherjones.com) Trump has denied wrongdoing, but investigations, including FBI probes, highlight how these ties facilitated his rise while exposing him to criminal elements. (quigley.house.gov)

Refusing to Pay Debts and Strategic Bankruptcies

One of Trump's most consistent non-criminal tactics for self-enrichment has been refusing to pay contractors, vendors, and even his own lawyers, forcing them into costly settlements or write-offs. A 2016 USA Today investigation uncovered over 60 lawsuits and hundreds of liens from workers claiming Trump stiffed them on payments for services rendered. (usatoday.com) Examples include a Florida painting contractor owed $34,863 for work on Trump National Doral golf resort, whom Trump paid only after litigation. (usw.org) In another case, a family carpentry business was denied over $80,000 for completed work on a Trump casino project, leading to financial ruin for the owners. (reddit.com) Trump has defended this by saying he withholds payment for "bad jobs," but records show he often disputes bills to negotiate down, enriching himself at others' expense. (jsonline.com) Even cities hosting his rallies have been left with unpaid bills exceeding $750,000 for security and venue costs. (youtube.com)

Trump's use of bankruptcy filings further exemplifies how he leverages the law to avoid responsibility while protecting personal wealth. His companies filed for Chapter 11 bankruptcy six times between 1991 and 2009, including the Trump Taj Mahal in 1991 and Trump Entertainment Resorts in 2009. (washingtonpost.com) These restructurings wiped out billions in debts owed to creditors and workers, such as the thousands of employees at his Atlantic City casinos who lost jobs and pensions. (docs.house.gov) Trump personally avoided financial ruin by separating his assets, emerging wealthier while others bore the losses— a strategy he boasted about as "smart" business.

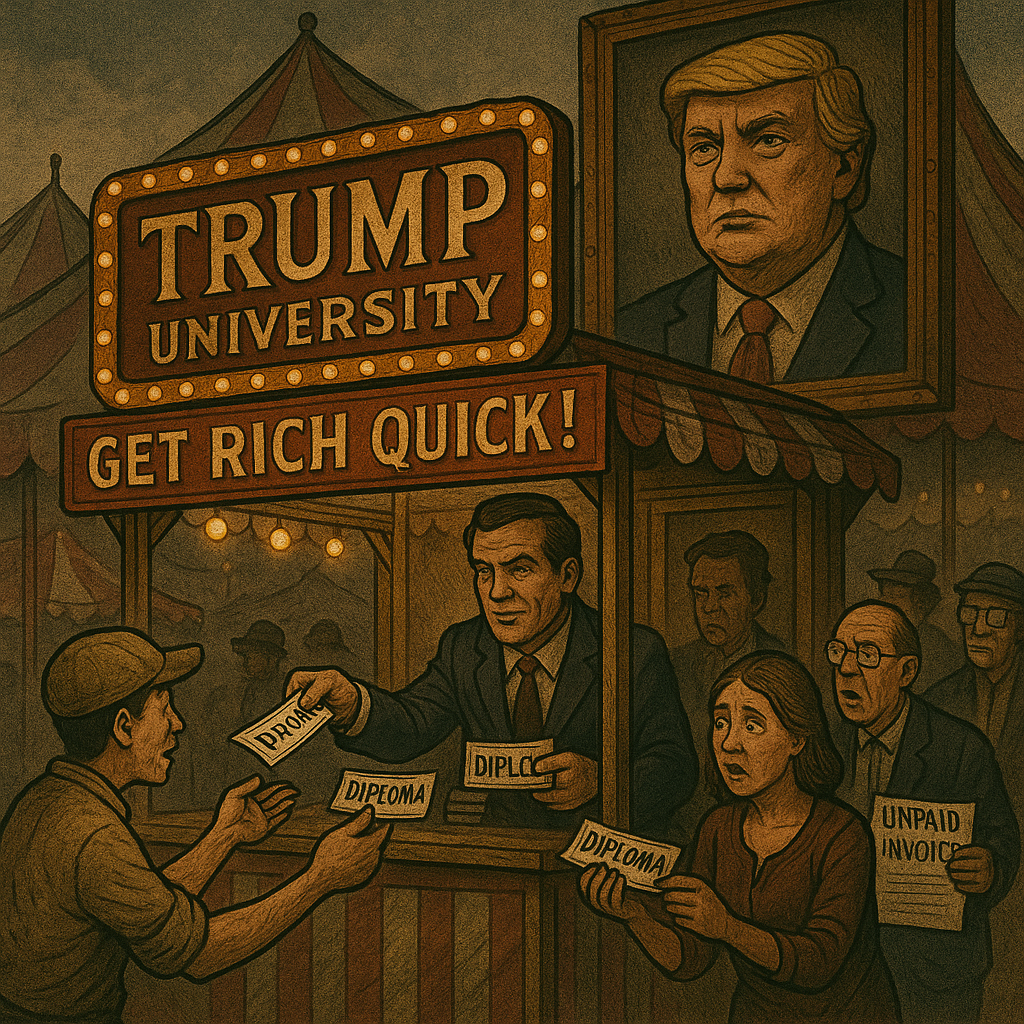

Fraudulent Enterprises: Trump University and Foundation

Trump's forays into education and philanthropy reveal patterns of fraud for personal gain. Trump University, marketed as a real estate seminar, defrauded thousands of students by promising insider knowledge from Trump himself, but delivered subpar content from unqualified instructors. (abcnews.go.com) In 2016, Trump settled three lawsuits for $25 million without admitting guilt, compensating victims who paid up to $35,000 for worthless courses. (npr.org) This scheme enriched Trump by millions while misleading vulnerable aspiring entrepreneurs. (en.wikipedia.org)

Similarly, the Donald J. Trump Foundation misused charitable funds for personal and political ends. In 2019, a New York judge ordered Trump to pay $2 million in damages for using foundation money to settle personal lawsuits and fund his 2016 campaign, including a $10,000 portrait of himself. (ag.ny.gov) The foundation was dissolved, with remaining assets redistributed to legitimate charities, highlighting Trump's disregard for nonprofit laws to benefit himself. (npr.org)

Tax Avoidance and Financial Manipulation

Trump's tax strategies border on evasion, using aggressive tactics to minimize liabilities. A 2018 New York Times investigation revealed he received over $413 million (adjusted for inflation) from his father through dubious schemes, including undervaluing assets to dodge gift taxes. (nytimes.com) He claimed massive deductions, paying little to no federal income tax in 10 of 15 years before his presidency, often by reporting business losses. (beyer.house.gov) These methods, while legal in parts, involved "suspect tax schemes" that enriched him at public expense. (library.columbia.edu)

Political Abuses: Emoluments, Hush Money, and Election Interference

As president, Trump violated the Emoluments Clause by profiting from foreign governments at his properties, like the Trump International Hotel in D.C., where officials from Saudi Arabia and China spent lavishly. (house.gov) A congressional report found he pocketed at least $7.8 million from 20+ countries, ignoring constitutional bans on foreign emoluments. (brennancenter.org)

In 2024, Trump was convicted on 34 felony counts for falsifying business records to cover hush money payments to Stormy Daniels, aimed at influencing the 2016 election. (apnews.com) He was sentenced but released without restrictions, marking him as the first former president convicted of felonies. (npr.org)

Trump faces ongoing charges for attempting to overturn the 2020 election. In Georgia, he and co-defendants were indicted for racketeering, including a call pressuring officials to "find" votes. (en.wikipedia.org) Federally, he's charged with conspiracy to defraud the U.S. related to January 6, 2021, insurrection, where he allegedly incited a mob to storm the Capitol. A special counsel report detailed his "unprecedented criminal effort" to subvert democracy. (ap.org)

Additionally, Trump was indicted for mishandling classified documents, retaining sensitive materials at Mar-a-Lago and obstructing recovery efforts. The case includes 40 felony counts, with evidence of him showing documents to unauthorized individuals. (pbs.org)

Personal Liabilities: Defamation and Assault Allegations

Trump's personal conduct has led to legal repercussions, including a 2023 jury finding him liable for sexually abusing and defaming writer E. Jean Carroll, awarding her $5 million. (en.wikipedia.org) A subsequent trial in 2024 added $83.3 million for continued defamation. (politico.com) These verdicts stem from Carroll's allegation of a 1990s assault, which Trump denied, leading to defamatory statements. (law.justia.com) At least 28 women have accused Trump of sexual misconduct since the 1970s, resulting in multiple settlements and lawsuits. (en.wikipedia.org)

Lesser-Known Controversies

Beyond headlines, Trump has faced lesser-known issues like a 2019 ethics complaint alleging he used a sham loan to avoid taxes on a Chicago property. (taxnotes.com) His administration saw over 3,700 conflicts of interest, including promoting family businesses while in office. (citizensforethics.org) Other suits involve birthright citizenship challenges and impoundment of congressionally approved funds, showcasing ongoing legal battles. (vox.com)

Conclusion

Trump's history demonstrates a consistent pattern: using legal gray areas, settlements, and denials to avoid full accountability while profiting personally. Whether through discrimination, fraud, or political abuses, these examples substantiate claims of criminal-like operations. As of 2025, with 88 criminal charges across cases (many ongoing), Trump's legacy underscores the challenges of holding powerful figures responsible. (citizensforethics.org)

This article was written with help from Grok.